does colorado have an estate or inheritance tax

Federal legislative changes reduced the state death. What state has the lowest estate tax.

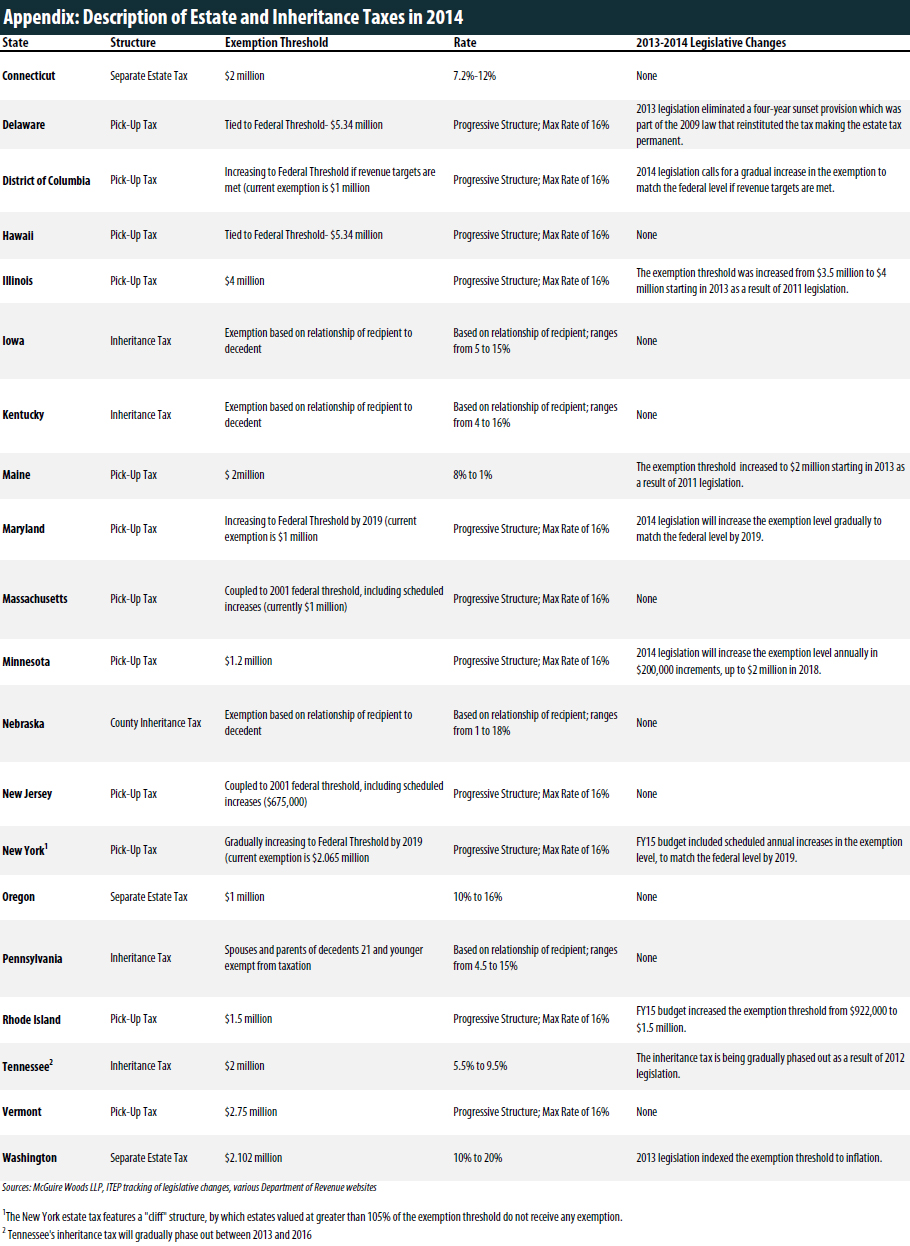

State Estate And Inheritance Taxes Itep

An experienced estate planning attorney can advise you about the steps you should take to establish domicile in a state.

. If you have questions about Estate tax Gift tax Death tax or Inheritance tax or if you simply need to address your estate planning in general please call our Trusts and. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. However there is still a federal limit.

Does Co have a state estate tax. However Colorado residents still need to understand federal estate tax laws. When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected.

A state inheritance tax was enacted in Colorado in 1927. Overall Rating for Taxes on Retirees. 14-10-113 deals with the division of marital property in a Colorado divorce.

When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. There is no estate tax in Colorado.

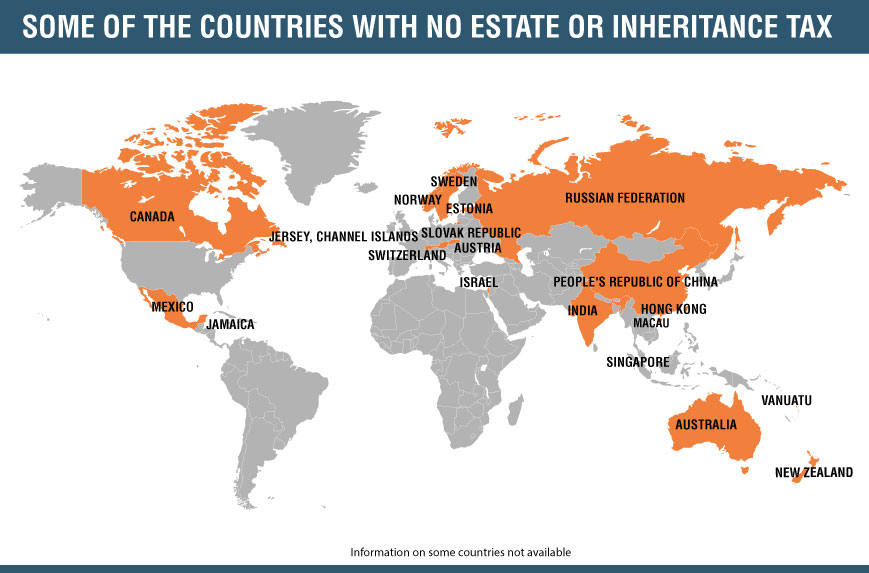

Colorado does not have an inheritance tax or estate tax. Inheritance Taxes When a person dies and leaves behind property that property will typically be transferred to family member inheritors. There is no estate or inheritance tax collected by the state.

Washington doesnt have an inheritance tax or state income tax but it does have an estate tax. Does Colorado have an inheritance tax. There is no inheritance tax in Colorado.

Davis Schilken PC Can Help. If you are domiciled in a state with no estate tax your estate will only have to pay estate taxes on real property or other tangible property you owned in the state with an estate or inheritance tax. Estate tax is a tax on assets typically valued at the.

In the previous thirty years the federal estate tax limit for an individual has ranged from 500000 to 10000000. However some estates might still be subject to federal estate taxes so it is important to understand how estate taxes work and whether they might apply to your estate. Colorado has no estate tax.

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. A state inheritance tax was enacted in Colorado in 1927. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. Colorado is not one of these states so anyone who dies leaving behind property in Colorado will not have to worry about estate taxes at the state level.

But that there are still complicated tax matters you must handle once an individual passes away. There is no estate or inheritance tax collected by the state. Localities can add as much as 56 to that but the average combined levy is 84 according to the Tax Foundation.

It is one of 38 states with no estate tax. What states do not have an estate tax. As a matter of fact you may have to file.

Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. The publication is provided by the American College of Trust and Estate Counsel.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. There is also no Colorado inheritance tax or gift tax imposed under state law. However Colorado residents still need to understand federal estate tax laws.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Betty White S Massive Estate Tax Bill And How Life Insurance Fixes It

State Estate And Inheritance Taxes Itep

Estate Planning Lawyer Batavia 630 406 5440 Elder Law Service Infographic Marketing Inheritance Tax Estate Planning

Contact Congress Policy And Taxation Group

How To Settle An Estate Pay Final Bills Dues Taxes And Expenses Everplans

Indiana Estate Tax Everything You Need To Know Smartasset

A New Era In Death And Estate Taxes

Map Of Earned Income Tax Credit Eitc Recipients By State Map Happy Facts United States History

Inheritance Tax Here S Who Pays And In Which States Bankrate

File Bierstadt Map Gif Albert Bierstadt South Dakota Old Maps

We All Need Plans To Minimize State And Federal Estate Taxes And These Plans Are Best Structured By A Profession Estate Tax Estate Planning Financial Services

A New Era In Death And Estate Taxes

The Federal Estate Tax An Important Progressive Revenue Source Itep

Inheritance Tax Here S Who Pays And In Which States Bankrate