internet tax freedom act us code

The internet tax freedom act and isp tax moratorium since 1998 taxing internet access has been prohibited under the internet tax freedom act itfa. The states would have collected nearly 1 billion in fiscal year 2021.

Cell Phone Tax Wireless Taxes Fees Tax Foundation

108435 text PDF is the current US.

. Back in 1998 Congress passed the original Internet Tax Freedom Act a temporary moratorium on taxing internet access. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the Permanent Internet Tax Freedom Act PITFA. And 2 to accelerate the growth of electronic commerce by expanding market access opportunities for the development of.

110108 for any period prior to June 30 2008 with respect to any tax subject to the exceptions described in subparagraphs A and B of paragraph 2. No inference of legislative construction shall be drawn from this subsection or the amendments to section 11055 made by the Internet Tax Freedom Act Amendments Act of 2007 Pub. Summary of HR1054 - 105th Congress 1997-1998.

A bi-partisan proposal introduced by Senator John Thune R-SD this bill would permanently prohibit taxation of internet access. This act which became public law 110-108 amends the internet tax freedom act to. 151 note preempts state and local.

Signed into law on December 3 2004 by George W. The United States by way of approval by the Senate on February 11 2016 passed a permanent expansion of the Internet Tax Freedom Act and was included in HR. If Congress does nothing states could start taxing your internet access by the end of the year.

Online sellers are still required to collect sales tax when selling items to buyers in states where you have sales tax nexus. The permanent Internet Tax Freedom Act ITFA 47 USC. Bush it extended until 2007 the then-current moratorium on new and discriminatory taxes on the Internet.

The Internet Tax Freedom Act and Federal Preemption Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would interfere with the free flow of interstate commerce over the internet. Internal revenue codes related to indian tribal government. 105-277 the Omnibus Appropriations Act of 1998 reproduced below establishes the Advisory Commission on Electronic Commerce.

02252015 As one of our more than 69 million FreedomWorks members nationwide I urge you to contact your senators today and ask them to support the Internet Tax Freedom Forever Act S. While the Internet Tax Freedom Act ITFA and its permanent counterpart PIFTA prevents states from imposing taxes on things like actually accessing the internet they do not have anything to do with eCommerce sales. The Internet Tax Freedom Act of 1998 ITFA.

Includes as negotiating objectives under such agreements. Federal law that bans Internet taxes in the United States. For the seven states that now levy a tax on internet usage the bill also sets an end date of June 30 2020.

1 extend the moratorium on state taxation of internet access and electronic commerce and the exemption from such moratorium for states with previously enacted internet tax laws preserving the grandfather provisions to protect revenues in those states and local. The Internet Tax Nondiscrimination Act PubL. Internet Tax Freedom Act.

It also established the Advisory Commission on Electronic Commerce. Since then the Act has been renewed but is now set to expire on November 1. 2020-1436 Internet Tax Freedom Acts prohibition against taxing internet access applies to all states beginning July 1 2020 On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire.

644 the 2015 Act on Trade Facilitation and Trade Compliance. TITLE XIMORATORIUM ON CERTAIN TAXES SEC. The Internet Tax Freedom Act formerly known as S442 now Title XI of PL.

The internet tax freedom act referred to in subsec. This title may be cited as the Internet Tax Freedom Act. The telecommunications act of 1996 has the potential to change the way we work.

105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1 new taxes on Internet access and 2 multiple or discriminatory taxes on electronic commerce. 1 to assure that electronic commerce is free from tariff and nontariff barriers burdensome and discriminatory regulation and discriminatory taxation.

Income Tax History Tax Code And Definitions United States

House Passes Secure Act 2 0 Requiring Automatic Enrollment In Retirement Plans

Internal Revenue Code Of 1986 Full Text Irs Tax Code Search

Hidden Costs Of Xfinity Fees Installation Costs And More

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Doing Business In The United States Federal Tax Issues Pwc

31 U S Code 3521 Audits By Agencies

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

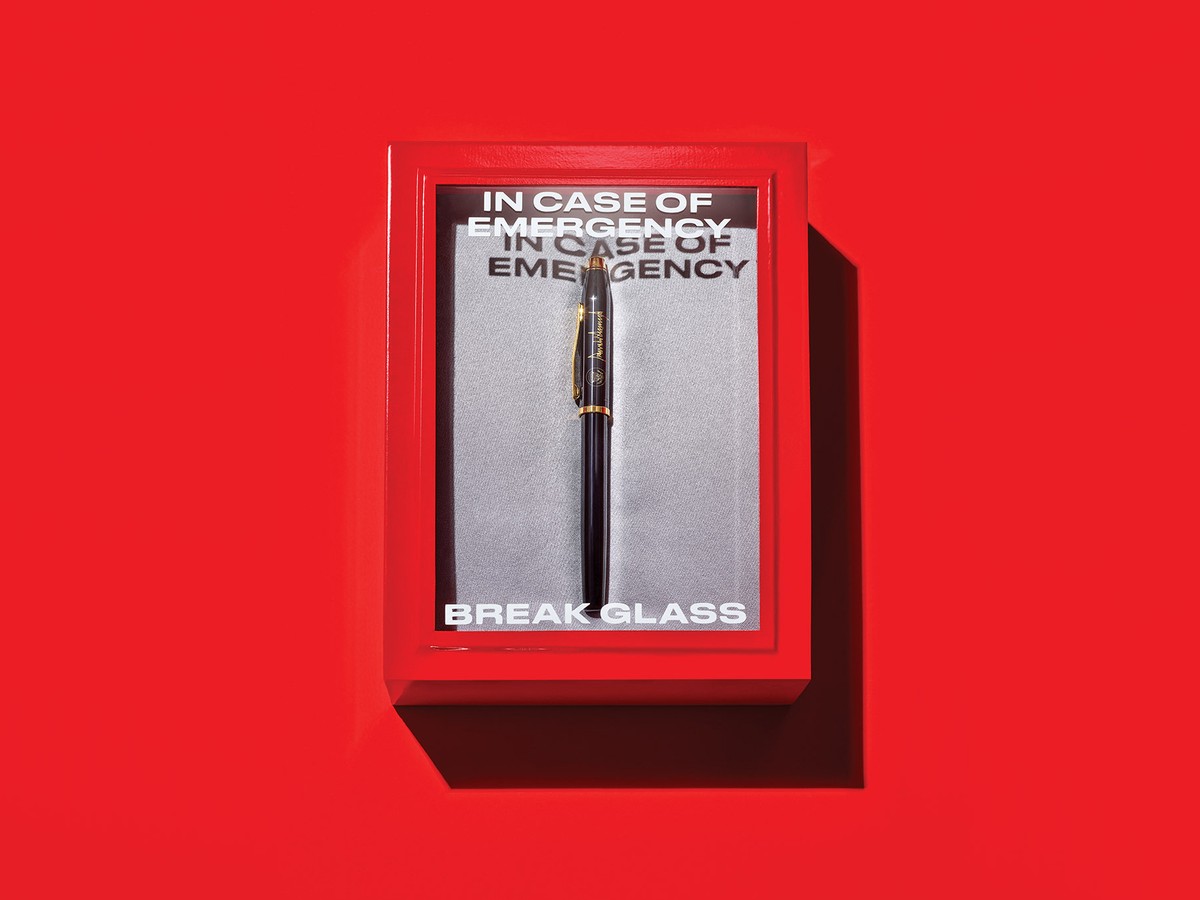

What Can A President Do During A State Of Emergency The Atlantic

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Municipal Broadband Is Restricted In 18 States Across The U S In 2021 Broadbandnow

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Federal Taxation I Individuals Employees And Sole Proprietors Coursera

Sales Tax By State Is Saas Taxable Taxjar

Data Protection Laws And Regulations Report 2022 Usa

Remote Work Tax Reform Improving Tax Mobility And Tax Modernization

A Guide To Anti Misinformation Actions Around The World Poynter