pay utah sales tax online

Local jurisdictions also have a sales and use tax rate. Utah is an origin-based sales tax state.

What Is Sales Tax A Complete Guide Taxjar

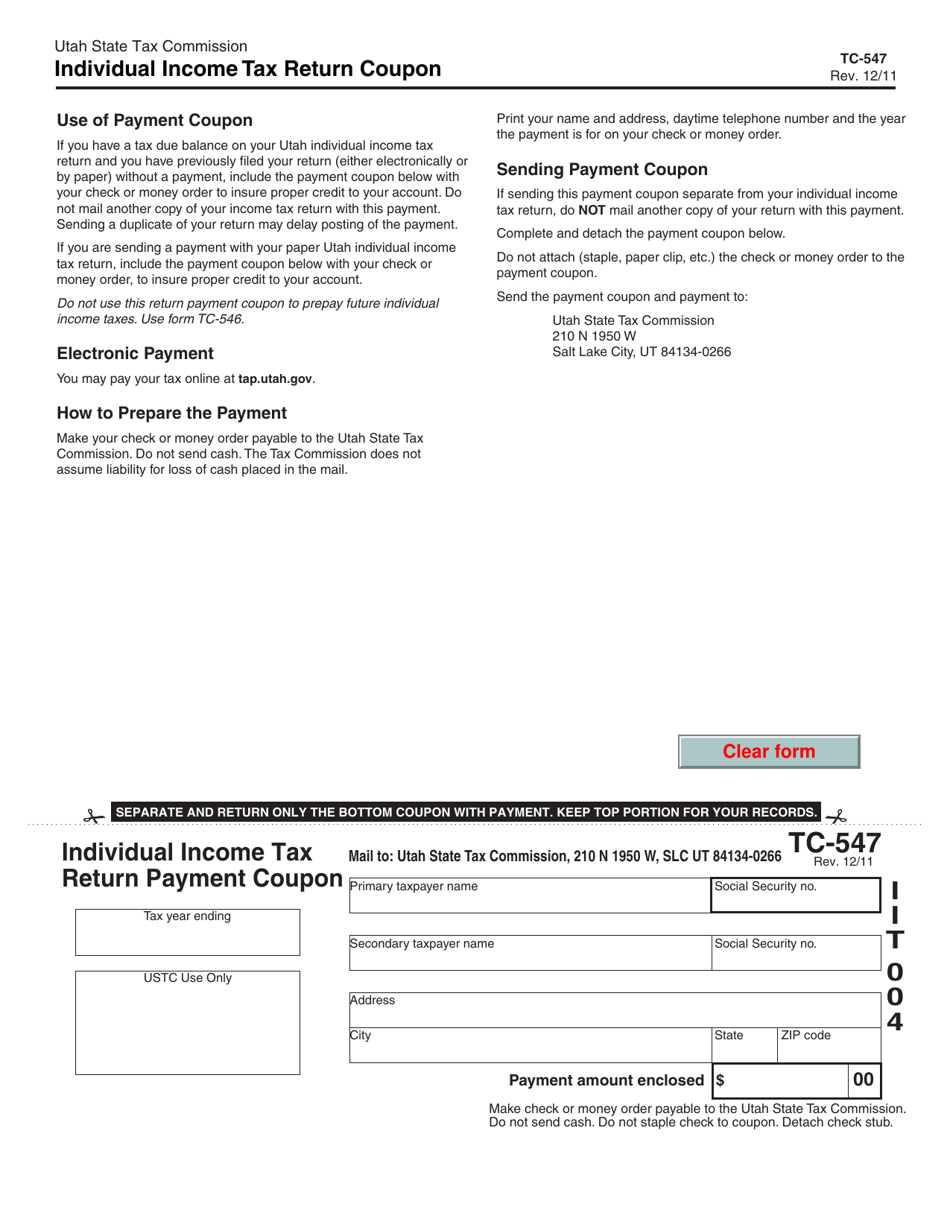

TC-62PC Sales Tax Payment Coupon.

. Remove any check stub before sending. Additionally the state has excise and special taxes for. If you owe Utah state taxes the following instructions will guide you through the process of making an online payment.

Utah first adopted a general state sales tax in 1933 and since that time the rate has. Utahs sales tax rate is 485 percent of retail goods and some services sold. To find out the amount of all taxes and fees for your.

Do not mail cash with your return. File electronically using Taxpayer Access Point at. You should now be on your homepage.

You will need to create an account and login to the website. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Filing Paying Your Taxes.

Create a Tax Preparer Account. Click the link above to be directed to TAP Utahs. If you have a Utah sales tax licenseaccount include the use tax on your sales tax return.

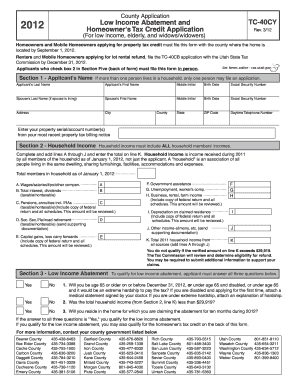

If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40. Pay over the phone by calling 801-980-3620 Option 1 for real property. What you need to pay online.

This section discusses information regarding paying your Utah income taxes. We cover more than 300 local jurisdictions. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Yes you can pay your property taxes online in Utah. Then click on Current Attributes. If you are mailing a check or money order please write in your account number and filing period or use a.

That rate could include a combination of. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. You will need your property serial number s.

To pay Real Property Taxes. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. Payment Types Accepted Online.

However they may voluntarily register to collect Utah sales tax at. Write your daytime phone number and 2021 TC-40 on your check. If you do not have these please request a duplicate tax notice here.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. In other words the Utah County sales tax rate will be. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Do not staple your check to your return. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. You can also pay online and.

See Utah Code 59-12-103 and Rules R865-12L R865-19S and R865-21U. Your property serial number Look up Serial Number. Click on Sales and Use Tax to get started.

This means you should be charging Utah customers the sales tax rate for where your business is located. Click on the period you want to file.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Utah Income Tax Calculator Smartasset

Fillable Online Abc Utah Utah State Tax Commission 210 N 1950 W Salt Lake City Ut 84137 Fax Email Print Pdffiller

How Do State And Local Sales Taxes Work Tax Policy Center

How To Pay Utah Tax Online Youtube

Form Tc 547 Download Fillable Pdf Or Fill Online Individual Income Tax Return Payment Coupon Utah Templateroller

How To File And Pay Sales Tax In Utah Taxvalet

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Fillable Online Utah State Sales Tax Exemption Form With Glens Key Filled In Fax Email Print Pdffiller

Utah Sales Tax Small Business Guide Truic

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

Utah Sales Tax Application Registration

Utah Sales Tax Guide And Calculator 2022 Taxjar

Fillable Online Utah State Tax Commission Address Form Fax Email Print Pdffiller

How To File And Pay Sales Tax In Utah Taxvalet